Worldwide, the impact of global change is being felt. While some people deny that climate change is even happening, the courts are, in fact, seeing the effects in the litigation scene. Suits concerning the issue are trending upwards. Jurisdictional restraints and distance are not stopping litigants from coming forward to file suit. Science, damages, and people being passionate about the cause have increased the number of people wanting to seek retribution, restraint or some form of way to mend harm done by being awarded damages and the cutting of carbon emissions. The biggest offenders? Large corporations. The Human Rights Commission in London is currently investigating the catastrophic effects of Typhoon Yolanda which affected those in the Philippines. The nexus between the polluting corporations with the effects on the environment is what will need to be established and whether the condition was exacerbated as a result of that pollution. The difficulty in being able to produce evidence to present this case and the distance of greater than six thousand miles is no bar.

One possible reason for the increase in lawsuits is the lack of response from governance. People are also more environmentally conscious and know of the impacts of gas emissions

when it comes to health, land and air quality. Successful litigation in this realm has not been as successful as environmentalists would like. However, the pendulum is shifting. Public

awareness and better-equipped machines with techniques to track results also tie in with that. A worldwide consensus is now there when it comes to damage. It is proving that a single

corporation is responsible and to what degree used to be more difficult than it is now. We also know that from a few prior posts on our blog, those actions have started in the USA

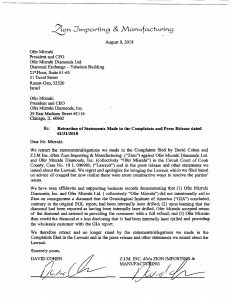

also. We discussed this when we looked at a suburban business in Chicago that is under scrutiny for implementation of a system in which the way they sterilized caused emissions of

a cancer-causing substance. The operational facility provided sterilization services to the medical, pharmaceutical and food industries. Ironically, the health damage by its emissions made locals

worse off. Continue reading ›

Chicago Business Litigation Lawyer Blog

Chicago Business Litigation Lawyer Blog